Budgeting for food is one of the most difficult things to do when traveling. It feels like both the concept of budget and calories go out the door the minute you land in a new city. While I can’t help much with the latter, I can definitely share some of my money saving tricks that will stretch your food budget much longer thanks to two dining cash back apps! Let’s compare the pros and cons of both the Franki app and the inKind app and which is best to download before your next trip!

The best way to maximize your savings while dining out is stacking a cash back app with a reward credit card that earns 3x the points on dining like the Savor card or the BILT card. It’s a completely legit way to double dip in your earning potential while eating out. Cash back apps used to be limited to online shopping, but thanks to apps like Franki and inKind, we’re now able to get cashback while eating out at restaurants too!

Table of Contents

Franki

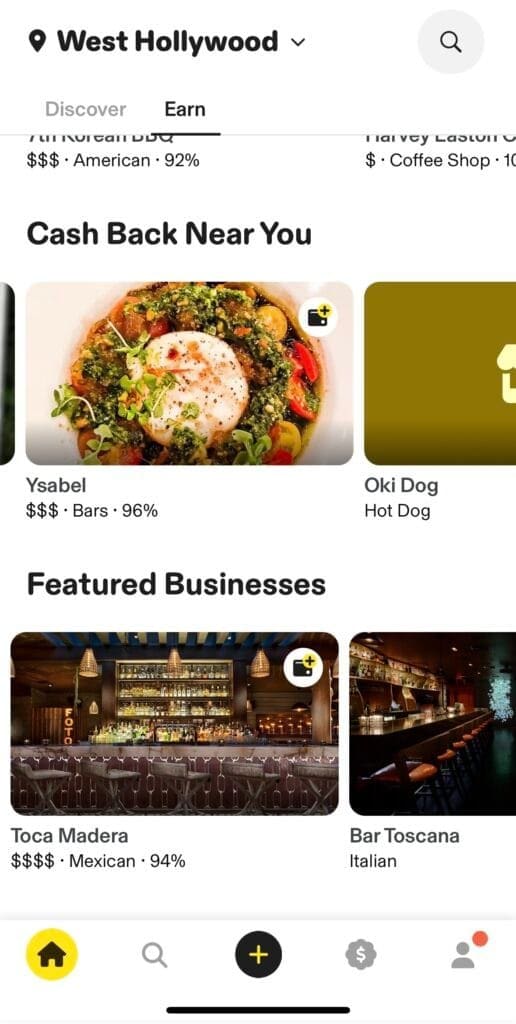

Released in 2023, Franki is a social discovery and video-based review app where users can interact with a community of foodies and discover local food spots while being rewarded with cash back at their favorite restaurants when ordering food with a linked card. It’s been dubbed “the TikTok for restaurant reviews” due to its users being incentivized for posting TikTok style video reviews of restaurants for additional rewards. Franki currently has over 5,000 restaurant listings and operates in 30 U.S. cities with plans to expand broadly into the U.S. by the end of 2025 and internationally within the following two years.

inKind

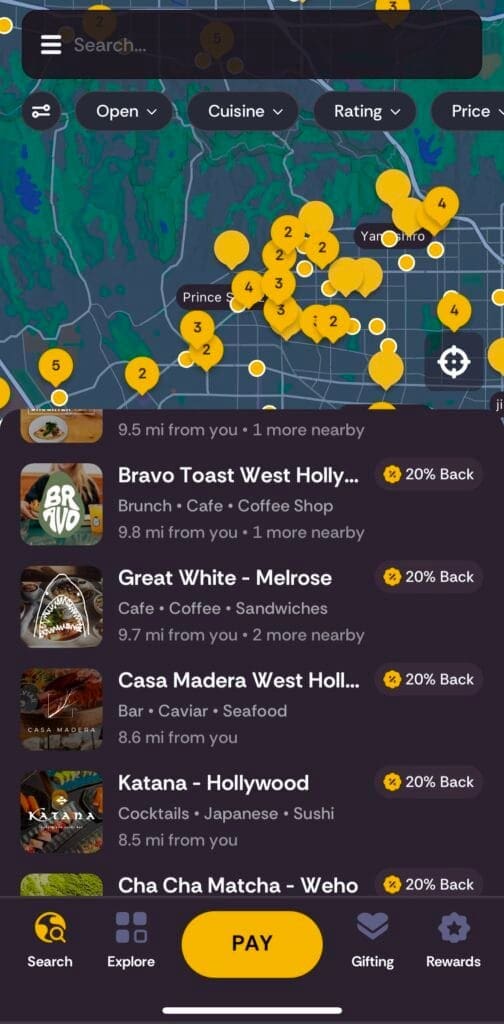

Created in 2017, inKind is a financial and marketing company that provides funding by purchasing a restaurant’s food and beverage credit up front which it then sells to diners. It’s a unique and fresh business model where inKind provides capital to restaurants and savings to patrons. Because it partners more closely with the restaurants, its network is much smaller than Franki’s, with roughly 3,000 restaurants mainly in major U.S. cities.

How do I start?

With both Franki and InKind, you are rewarded for dining at select restaurants by linking one or more credit card within the apps after downloading them from the App Store onto your phone. After this step, they start to differ greatly in their reward approach.

Earning Rewards

Franki

With Franki, you are rewarded 5% cash back when you activate an offer at a participating restaurant in the app before paying. It’s simple and straight forward to activate an offer with a single click. All you have to do is use the card that you linked up earlier on the app to pay and you’ll see your cashback within the Franki app by the next day.

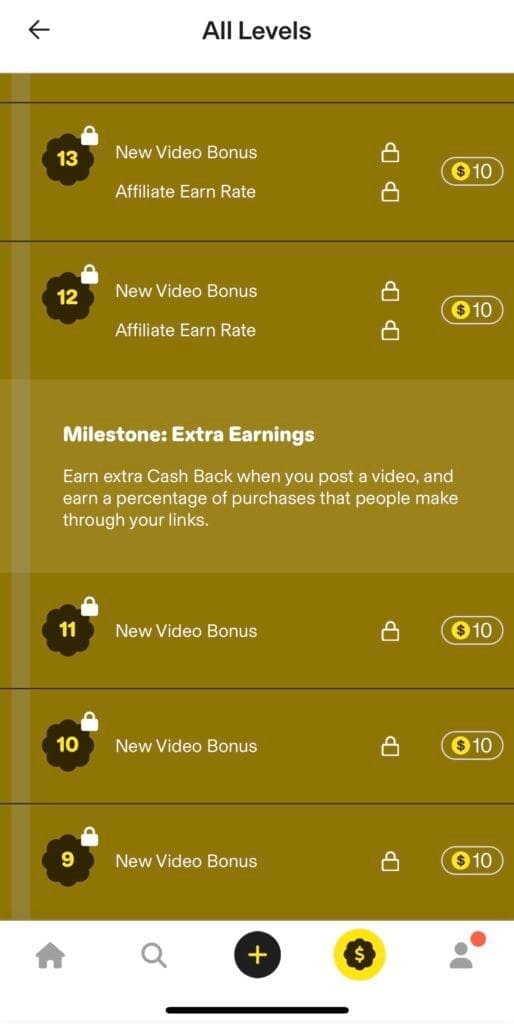

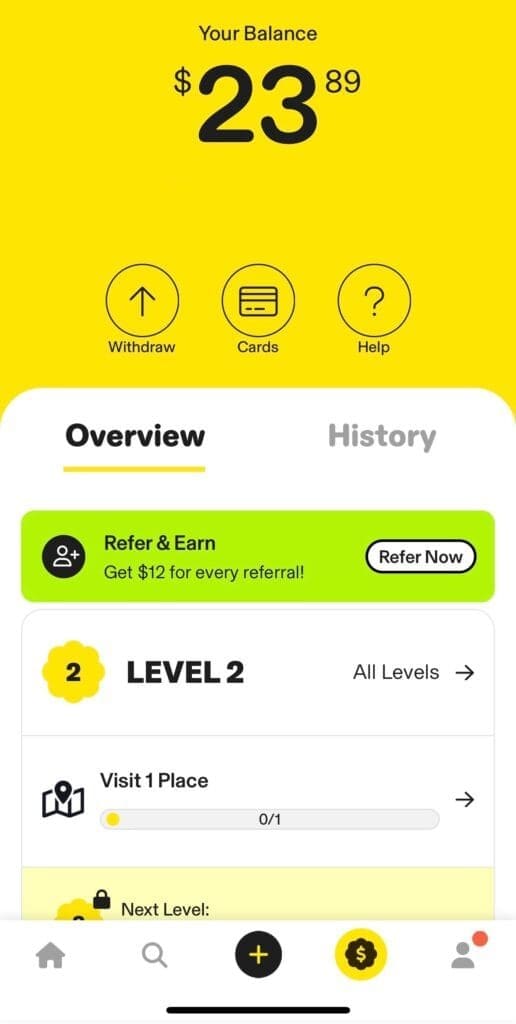

There are also sign up bonuses that they occasionally offer, like $15 cash back when you make your first purchase. In addition, there are bonuses for “leveling up”. The more you use the app, the more levels up you go with extra cash back bonuses at certain benchmarks.

If you post a video review of the restaurant in the app, you’ll get an extra 1% cash back, as well, and recommendation bonuses for other users’ purchases made through the content you post. Some restaurants will also run promotions in the app where they offer up to 20% cash back instead of the usual 5% cash back too. There are so many ways to earn cash back with the Franki app!

inKind

Although inKind’s network of restaurants is smaller, you earn a whooping 20% cash back through the app! I found it hard to believe until I started using the app since it sounded too good to be true. Whereas with Franki you activate an offer before paying and then pay as you normally would with your credit card, inKind’s system is like nothing I’ve seen before.

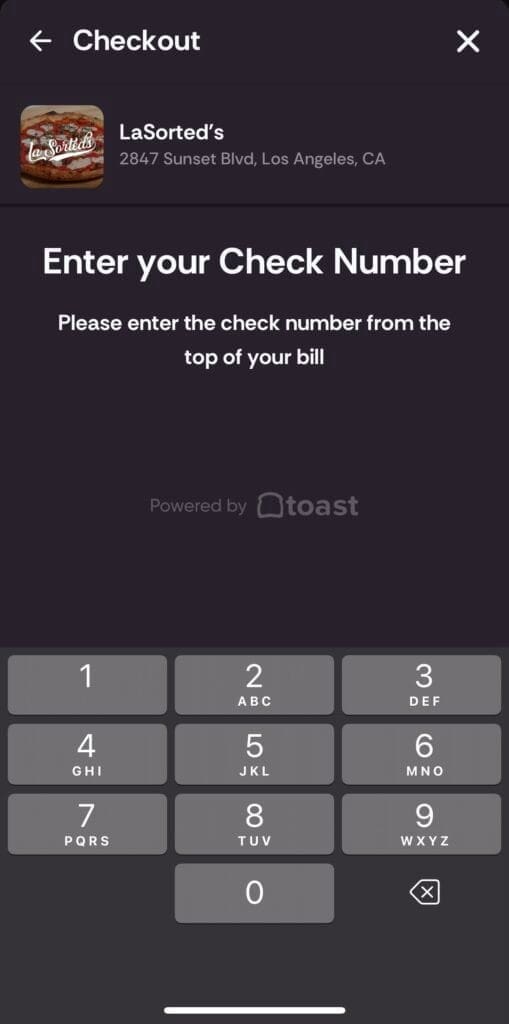

When you are given the check at the end of your meal, you open the app and select the restaurant then click “pay bill”. You’re then instructed to enter the check number and it will pull the bill information right in the app. You then select your tip amount and pay all through the inKind app. When it’s all done, your 20% cash back appears in the app by the next day.

The first time I paid with the inKind app, I embarrassingly had to wave down the waitress before closing the app to make sure I did it right since it felt weird to just leave the restaurant and not taking out any cash or a credit card, but she assured me that it instantly pops up on their computer system that I paid using the inKind app. I still feel the need to let the waitress know I paid through the app every time so I’m not accused of dining and ditching.

Referral Offers

Since Franki and inKind are putting in great efforts to grow and expand their reach, both offer very lucrative referral offers.

Franki

For every friend you invite to the Franki app, you earn $12 cash back. The friend that you referred also gets a great deal with 10% cash back instead of just 5% for their first month.

inKind

For every friend you invite to the inKind app, you earn $25 cash back! That’s double of what you earn with Franki! Plus the friend that you referred will also get $25 off of $50 at any of their participating restaurants.

Withdrawing Cash Back

Franki

When you want to withdraw all your cash back from the Franki app, you simply connect your checking account to the app to have it transferred over. Although, I would have loved an option to transfer it to Venmo or Paypal, overall it’s an easy, no strings attached withdrawal processes.

inKind

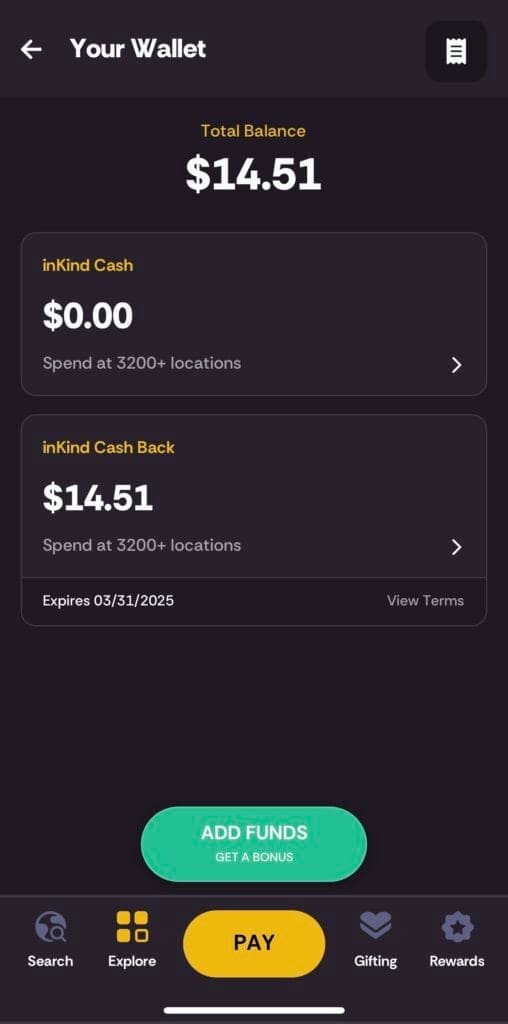

The only downside to inKind is its withdrawal process—there is none. The cash back you earn through the app goes to your inKind wallet, with which you can pay your bill with. When you pay with your cash back earnings, you don’t earn cash back though (that would be a hell of a loophole!). It’s not entirely bad considering the much higher earning rate than Franki, and free food is a very appealing reward in my book.

This is also a good place to note another fun feature of inKind—

You can also buy deeply discounted dining credits within the app to pay your bill with. Depending on the amount you choose, the bonus value varies between 25%-33%. The paid value never expires, but the bonus value expires in 3 years. Of course, just like when paying with cash back rewards, you won’t earn an additional 20% cash back.

Pros and Cons

| TikTok style reviews | Less rewarding than inKind |

| Easy reward withdrawals | |

| Large network of restaurants |

| Pros of in | |

| Consistent 20% cash back amount | Cash back cannot be withdrawn from the app |

| Massive referral incentive | Smaller network of participating restaurants |

| Cash back expires after two months of no activity |

Both the Franki and inKind apps have their pros and cons, as you can see. However, there is no reason why you can’t have both! I personally use both apps depending on the restaurant. Before discovering these apps, I only was receiving 3x cash back on my reward credit cards at restaurants. By linking my reward credit cards to both apps, I earn between 8% and 23% cash back when I dine out. If you live in a major U.S. city or plan on visiting one, then you should definitely download both the Franki and inKind app to stretch your food budget further.

Sign up here to earn 10% cash back your first month with Franki, and here to earn $25 off $50 with inKind!

If you want to learn more about reward credit cards, click here for my favorite reward credit cards and here on how to get started with credit card churning for free travel.